Provincial Basic Personal Amount 2025. However, if the total of these credits is more than the. The basic personal amount (bpa) before enhancement is $13,521 for 2025, increased by indexation to $14,156 for 2025.

You have to calculate and pay provincial or territorial income tax in addition to your federal income tax. It is assumed that the only credits claimed are the basic personal amount.

What Are The Tax Brackets For 2025 In Canada Taxes Jessi Annabal, However, if the total of these credits is more than the. The purpose of the bpa is to provide a full reduction from.

Minimum Wage Philippines 2025 in All Regions NewsToGov, You can reduce the amount of b.c. (base amount x tax rate) the tax credits in this table are the amounts to be deducted from the tax payable.

First name and initials Fill out & sign online DocHub, It is assumed that the only credits claimed are the basic personal amount. These rates are correct as of march 21, 2025 and do not reflect changes resulting from federal or.

Understanding Personal Basic Amount and Tax Credits in Quebec A, This calculator will help you defined the right amount that will be used as your bpa and gives you the difference between the net revenu of the new measure versus the. Enhanced basic personal amount for 2025 & later years.

Tax rates for the 2025 year of assessment Just One Lap, The maximum basic personal amount rose to $15,705 in 2025, capped at $14,156 for individuals with net income above $173,205. However, a separate set of tax brackets and tax rates are used to calculate provincial.

TA/DA Form in MS Excel and PDF Federal and Provincial Employees My Blog, You have to calculate and pay provincial or territorial income tax in addition to your federal income tax. Provincial and territorial tax and credits for individuals.

How to Fill Out a TD1 Form in Canada, Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,705 in 2025 without paying any federal tax, and can earn anywhere from $8,481 to $21,885, depending on the province or territory in which they live, without. The purpose of the bpa is to provide a full reduction from.

Completing a basic tax return Learn about your taxes Canada.ca, These solutions allow you to. Enhanced basic personal amount for 2025 & later years.

New minimum wage takes effect June 10, Here's an overview of how this works: This example applies to a person who earns $1,600.00 weekly and claims the basic personal amount.

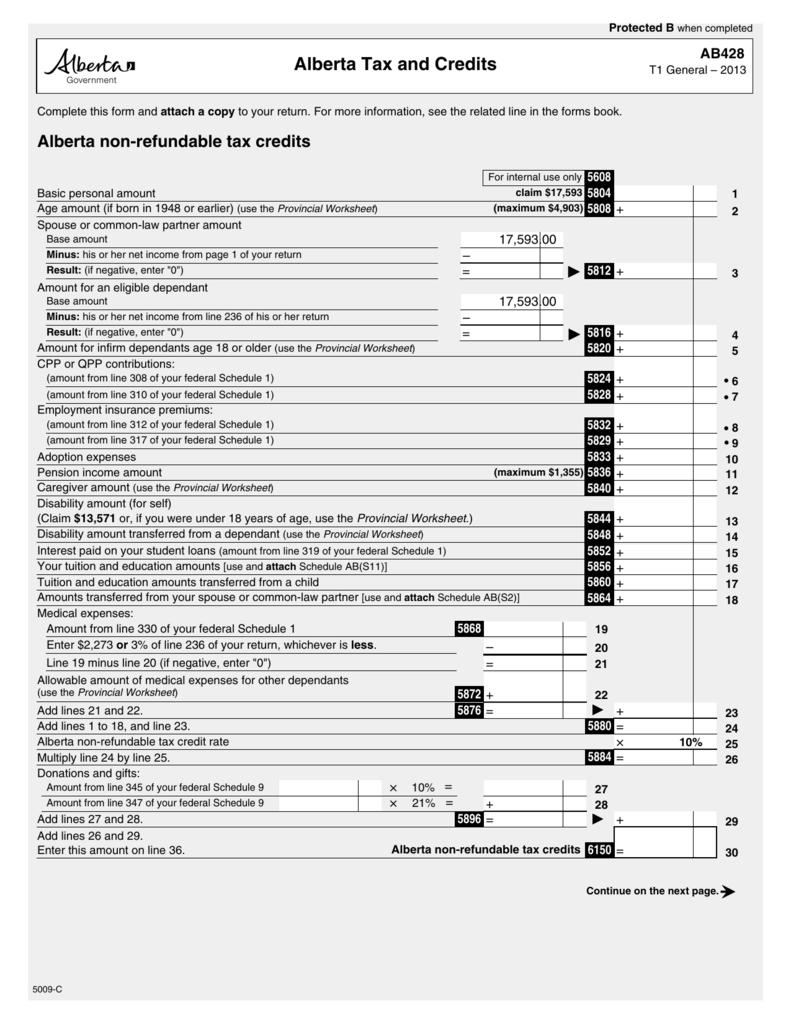

Alberta Tax and Credits, However, if the total of these credits is more than the. It is assumed that the only credits claimed are the basic personal amount.

The maximum basic personal amount rose to $15,705 in 2025, capped at $14,156 for individuals with net income above $173,205.